TIAからのお知らせ

- 24/03/29

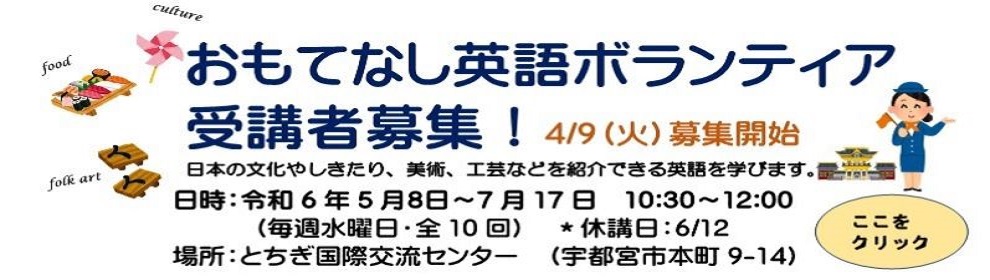

- 【4月9日(火)受付開始】おもてなし英語ボランティア参加者募集!

- 24/03/27

- 最新の栃木県外国人住民数現況調査結果(令和5(2023)年12月31日現在)について

- 24/03/27

- 令和5年度 JICA海外協力隊 活動報告会inとちぎ(3/9実施)の動画をアップしました

- 24/03/08

- 令和5年度 JICA筑波 教師海外研修・授業実践報告会(2/24実施)の動画をアップしました

- 24/02/20

- 「水平線のムコウ 元領事のつれづれ話 PART3」を発行しました

- 24/02/16

- 【外国につながる児童の教育に携わるみなさまへのお役立ち情報】11か国の教育制度・学校文化ガイド集(日本語版・各国語版)

- 23/12/23

- 「とちぎ多文化共生フォーラム2023」(2023年12月9日実施)の動画をアップしました!

- 23/06/20

- 【支援者対象】オンライン日本語学習の支援方法を学びたい方へ

- 23/06/20

- 【支援者対象】オンラインによる日本語学習が支援できる方へ

- 23/04/07

- 「JICA筑波施設訪問」募集

その他のお知らせ

- 24/04/16

- 農業交流プログラム with 東ティモール 報告会(4/25開催)参加者募集

- 24/04/04

- 【佐野】羊毛フェルトで解決! ケニアで障害と共に生きる子どもとお母さんを孤立から救う!(5/12開催)

- 24/04/02

- 「地球・おもいやりマルシェ」開催(5/12)のお知らせ

- 24/03/26

- 【2次募集】2024年度 南インディアナ日本人補習校 南インディアナ大学 留学プログラム 参加者募集!

- 23/12/16

- 第五回 JICA 海外移住「論文」および「エッセイ・評論」募集のお知らせ

- 23/10/19

- 栃木県の自転車条例が制定されました

- 22/11/12

- NHK World Japan「ひきだす にほんご Activate Your Japanese!」

- 22/01/06

- 国民生活センターが、よくある消費生活トラブルについて、多言語で注意点を紹介しています。

- 20/11/24

- (タイ人向け)LINEによる相談ホットライン(สายด่วนที่ปรึกษาออนไลน์เบื้องต้น)のご案内

- 20/11/06

- 高等学校等就学支援金制度